Child Tax Credit 2024 Eligibility Requirements Chart – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . Congressional negotiators announced a roughly $80 billion deal on Tuesday to expand the federal child tax credit that, if it becomes law, would make the program more generous, primarily for low-income .

Child Tax Credit 2024 Eligibility Requirements Chart

Source : www.cpapracticeadvisor.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : kvguruji.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

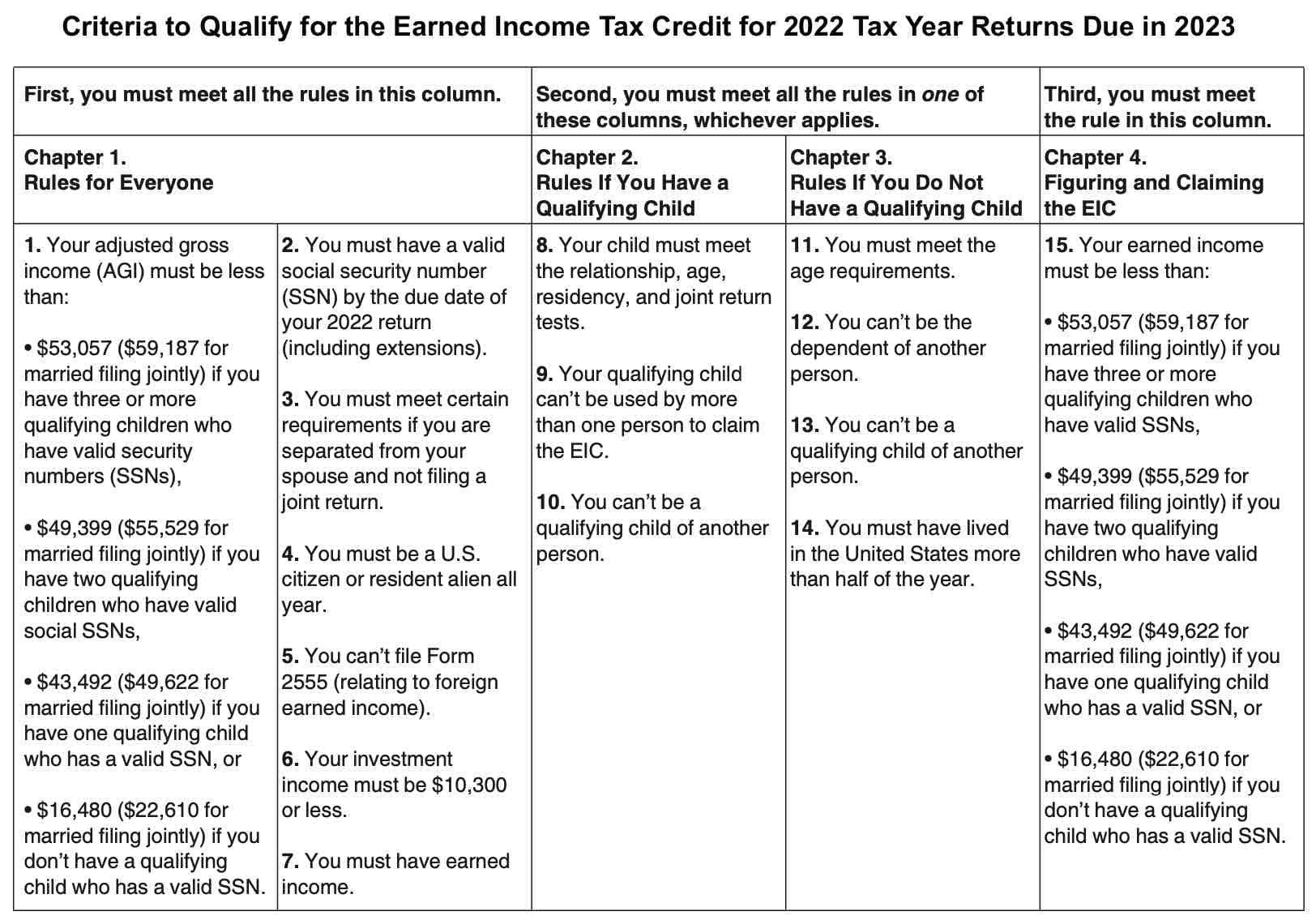

Earned Income Tax Credit, EITC; Tax Credit Amounts, Limits

Source : www.efile.com

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

Health Insurance Marketplace Calculator | KFF

Source : www.kff.org

Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®

Source : www.hrblock.com

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

Child Tax Credit 2024 Eligibility Requirements Chart IRS Issues Table for Calculating Premium Tax Credit for 2024 CPA : The child tax credit and other family tax credits and deductions can have a significant impact on your tax liability and potential refund. However, the qualifications and amounts f . During the COVID pandemic, the child tax credit was expanded with payments made monthly. It’s back to pre-pandemic levels, however, but, if you have children under the age of 17, you could be eligible .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)