California Tax Brackets 2024-25 – Before the tax increase, California was ranked by Kiplinger as the most expensive state for millionaires, and it’s more expensive for 2024. The payroll tax expansion increases the state’s top income . For 2024, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, .

California Tax Brackets 2024-25

Source : www.forbes.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

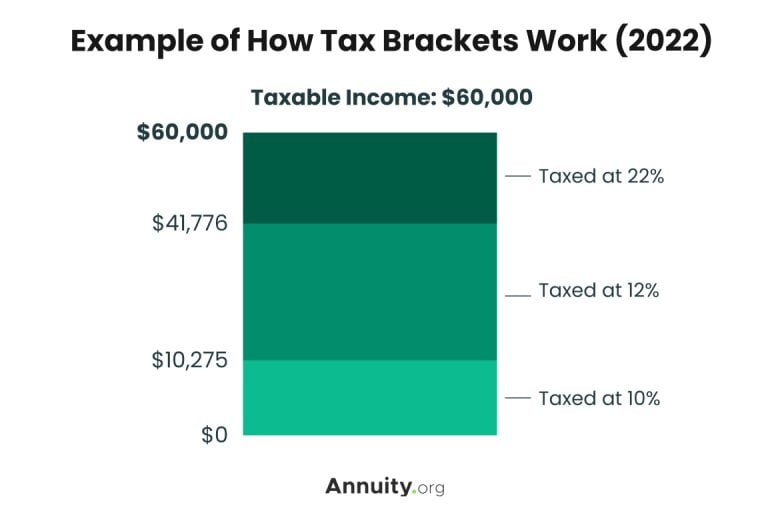

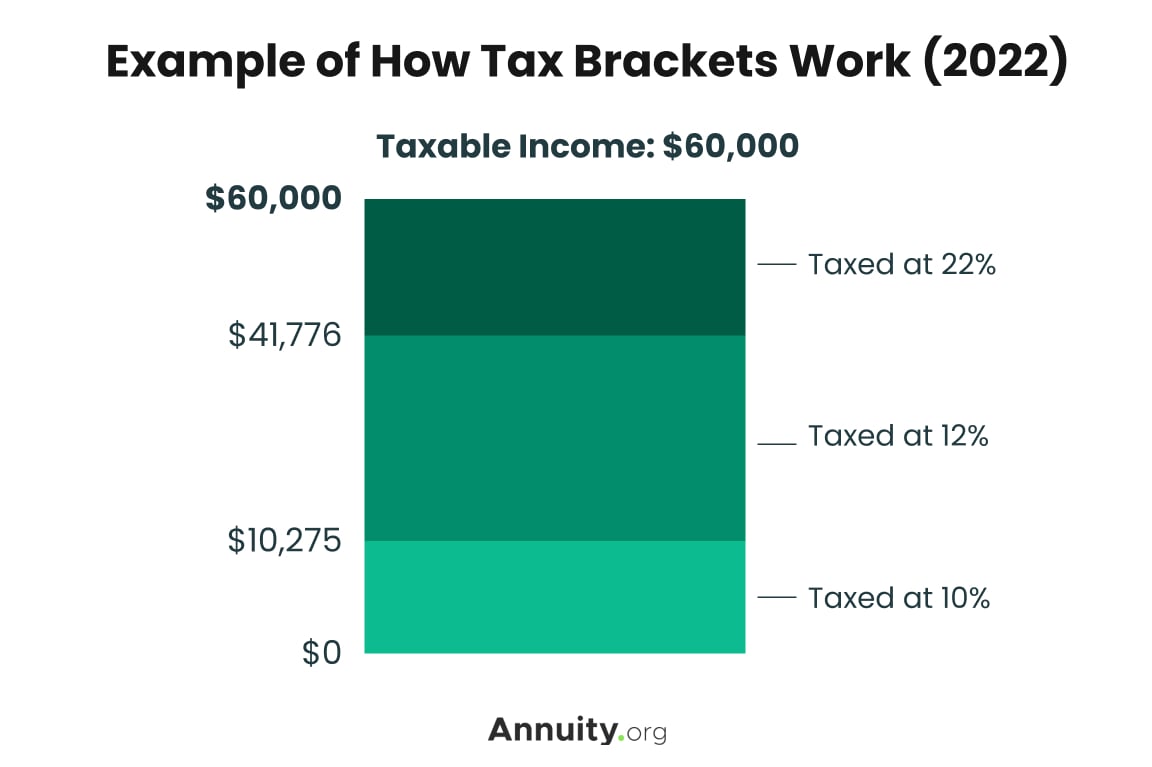

Tax Brackets for 2023 2024 & Federal Income Tax Rates

Source : www.annuity.org

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

Tax Brackets for 2023 2024 & Federal Income Tax Rates

Source : www.annuity.org

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

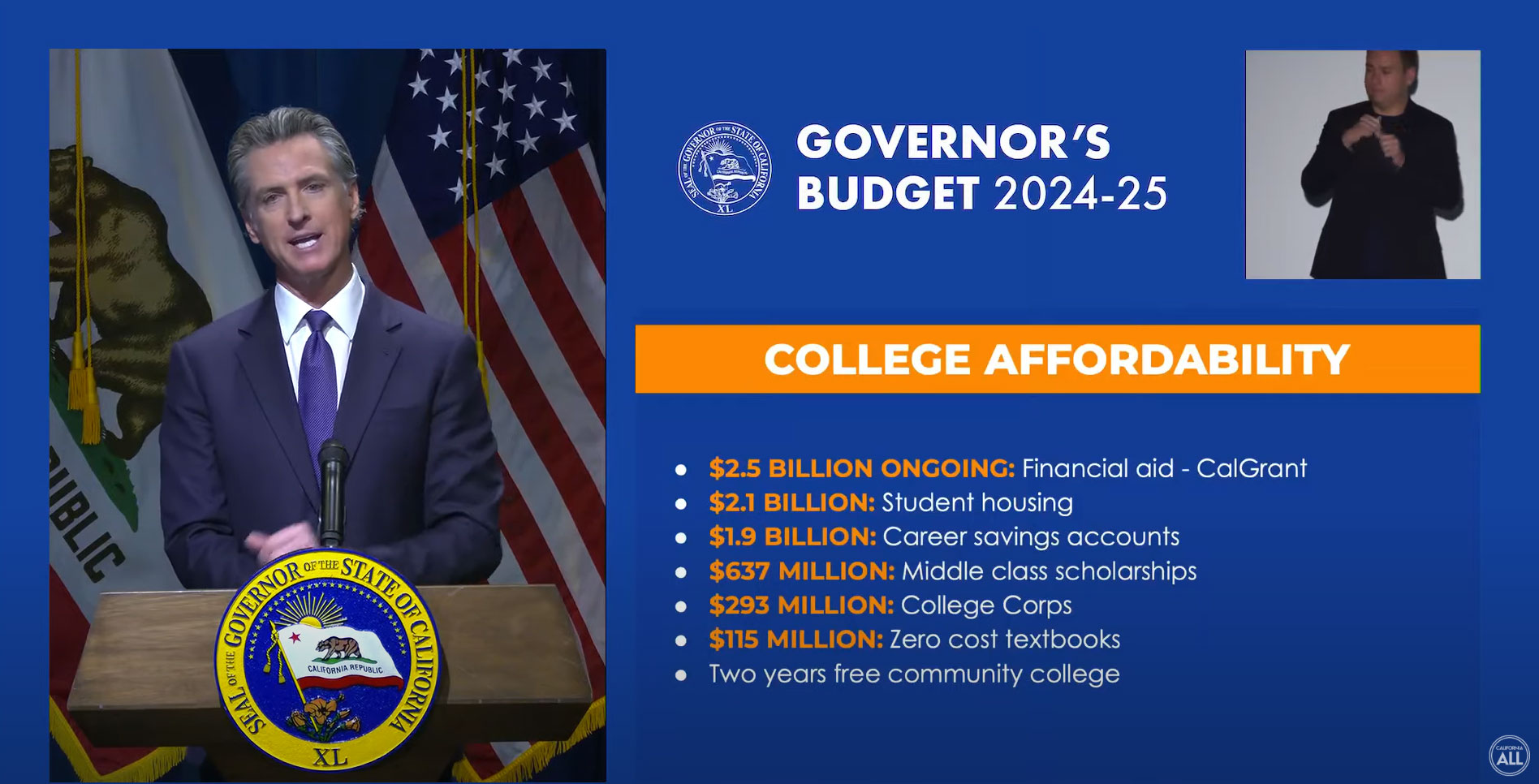

The California Budget 2024 2025: Correction and Normalization

Source : www.sdccd.edu

California Tax Brackets 2024-25 Your First Look At 2024 Tax Rates: Projected Brackets, Standard : How do tax brackets work? A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. This doesn’t mean all of their income is taxed at that rate. Their effective . The state’s heavy reliance on income tax leaves the California budget uniquely vulnerable 2023-24 and $30 billion higher or lower for 2024-25.” .